Be in command of the way you develop your retirement portfolio by utilizing your specialized know-how and passions to invest in assets that match with the values. Received knowledge in real estate property or personal fairness? Utilize it to help your retirement planning.

Irrespective of whether you’re a money advisor, investment issuer, or other fiscal Expert, take a look at how SDIRAs can become a powerful asset to improve your enterprise and achieve your Qualified goals.

A self-directed IRA is undoubtedly an very powerful investment car or truck, nonetheless it’s not for everyone. Since the indicating goes: with excellent electrical power arrives wonderful accountability; and using an SDIRA, that couldn’t be far more real. Keep reading to learn why an SDIRA could possibly, or may not, be for you.

Bigger investment selections suggests it is possible to diversify your portfolio past stocks, bonds, and mutual cash and hedge your portfolio towards current market fluctuations and volatility.

At times, the fees affiliated with SDIRAs is often larger and a lot more sophisticated than with a daily IRA. It's because of the greater complexity affiliated with administering the account.

Larger Service fees: SDIRAs usually come with higher administrative costs when compared with other IRAs, as specific components of the executive approach can not be automatic.

This includes knowing IRS rules, taking care of investments, and preventing prohibited transactions that could disqualify your IRA. A lack of knowledge could result in pricey mistakes.

Believe your Close friend could be setting up the following Fb or Uber? Having an SDIRA, you'll see it here be able to put money into causes that you believe in; and perhaps love higher returns.

Entrust can help you in buying alternative investments with your retirement cash, and administer the obtaining and providing of assets that are usually unavailable via banks and brokerage firms.

Going funds from one particular variety of account to a different type of account, check my source like shifting money from a 401(k) to a standard IRA.

Have the liberty to take a position in Nearly any sort of asset by using a threat profile that fits your investment method; such as assets which have from this source the probable for an increased charge of return.

Sure, housing is one of our purchasers’ hottest investments, sometimes identified as a real estate IRA. Purchasers have the choice to invest in anything from rental properties, industrial real estate property, undeveloped land, home loan notes and even more.

Because of this, they have a tendency not to market self-directed IRAs, which supply the flexibility to take a position inside of a broader array of assets.

Once you’ve found an SDIRA company and opened your account, you might be thinking how to really get started investing. Understanding both of those The foundations that govern SDIRAs, in addition to ways to fund your account, might help to lay the foundation for your way forward for effective investing.

Opening an SDIRA can present you with use of investments Typically unavailable via a bank or brokerage business. Listed here’s how to start:

Contrary to stocks and bonds, alternative assets are frequently harder to sell or can have rigorous contracts and schedules.

For those who’re trying to find a ‘established and forget’ investing method, an SDIRA likely isn’t the proper decision. Because you are in full Handle over each individual investment manufactured, It is your decision to carry out your individual due diligence. Recall, SDIRA custodians aren't fiduciaries and can't make tips about investments.

The most crucial SDIRA guidelines through the IRS that buyers have to have to comprehend are investment limitations, disqualified people, and prohibited transactions. Account holders ought to abide by SDIRA procedures and regulations to be able to preserve the tax-advantaged status of their account.

Selection of Investment Choices: Ensure the provider enables the types of alternative investments you’re thinking about, for example real estate property, precious metals, or personal equity.

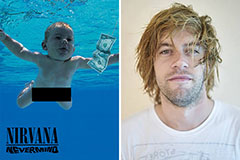

Spencer Elden Then & Now!

Spencer Elden Then & Now! Ben Savage Then & Now!

Ben Savage Then & Now! Brian Bonsall Then & Now!

Brian Bonsall Then & Now! Tyra Banks Then & Now!

Tyra Banks Then & Now! Nicholle Tom Then & Now!

Nicholle Tom Then & Now!